Tomorrow’s businesses will expect much more from their supply chains, which are creating more value than ever thanks to digital and analytics. Will you have the right talent to meet the demand?

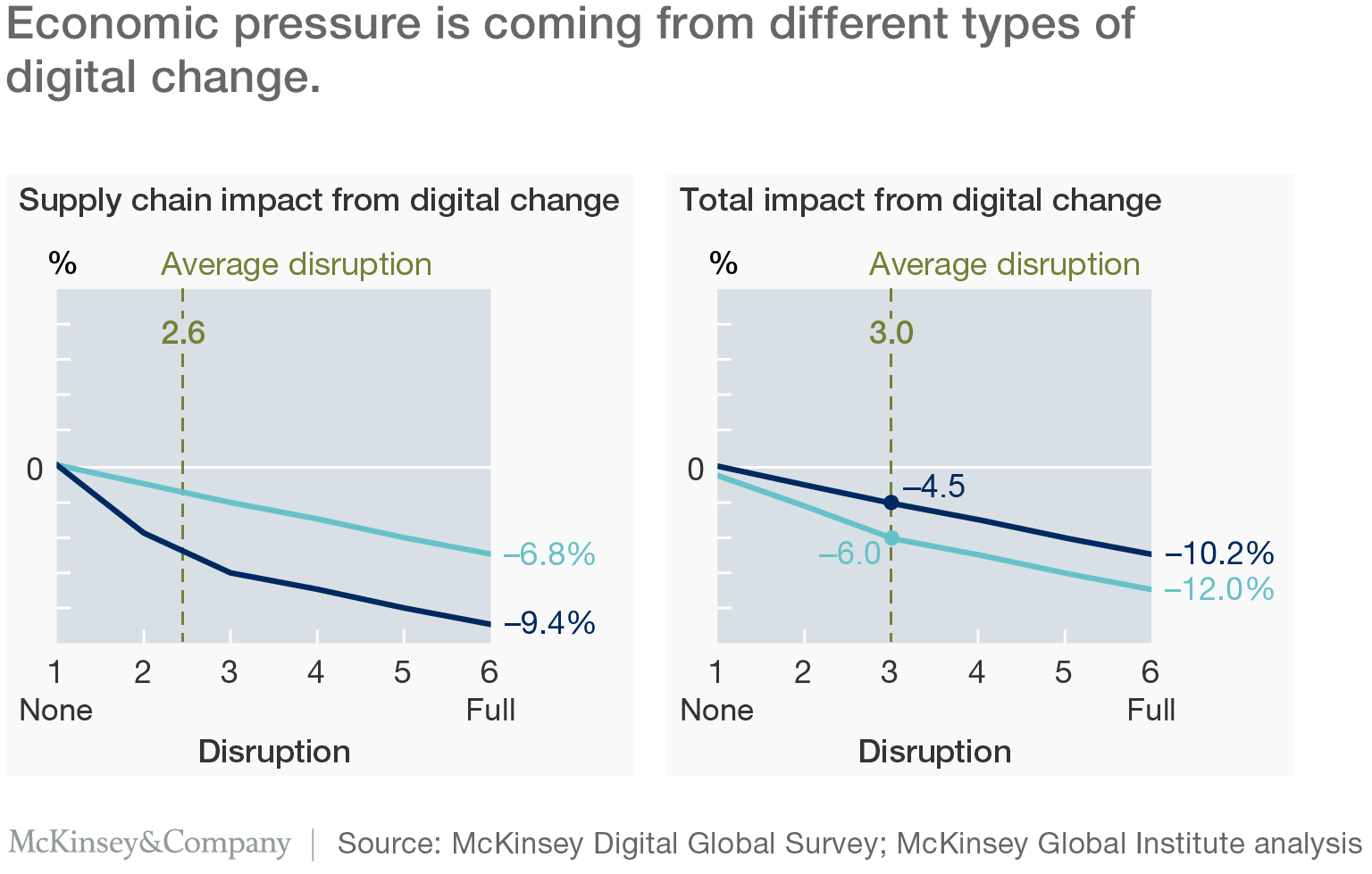

Over the coming years, the digitization of supply chains will likely have a significant effect on companies’ prospects. Research conducted as part of the McKinsey Digital Global Survey in 2016 shows that the end-to-end digitization of the supply chain will contribute more than two-thirds of businesses’ projected annual revenue growth, and more than 75 percent of annual EBIT growth (Exhibit 1).

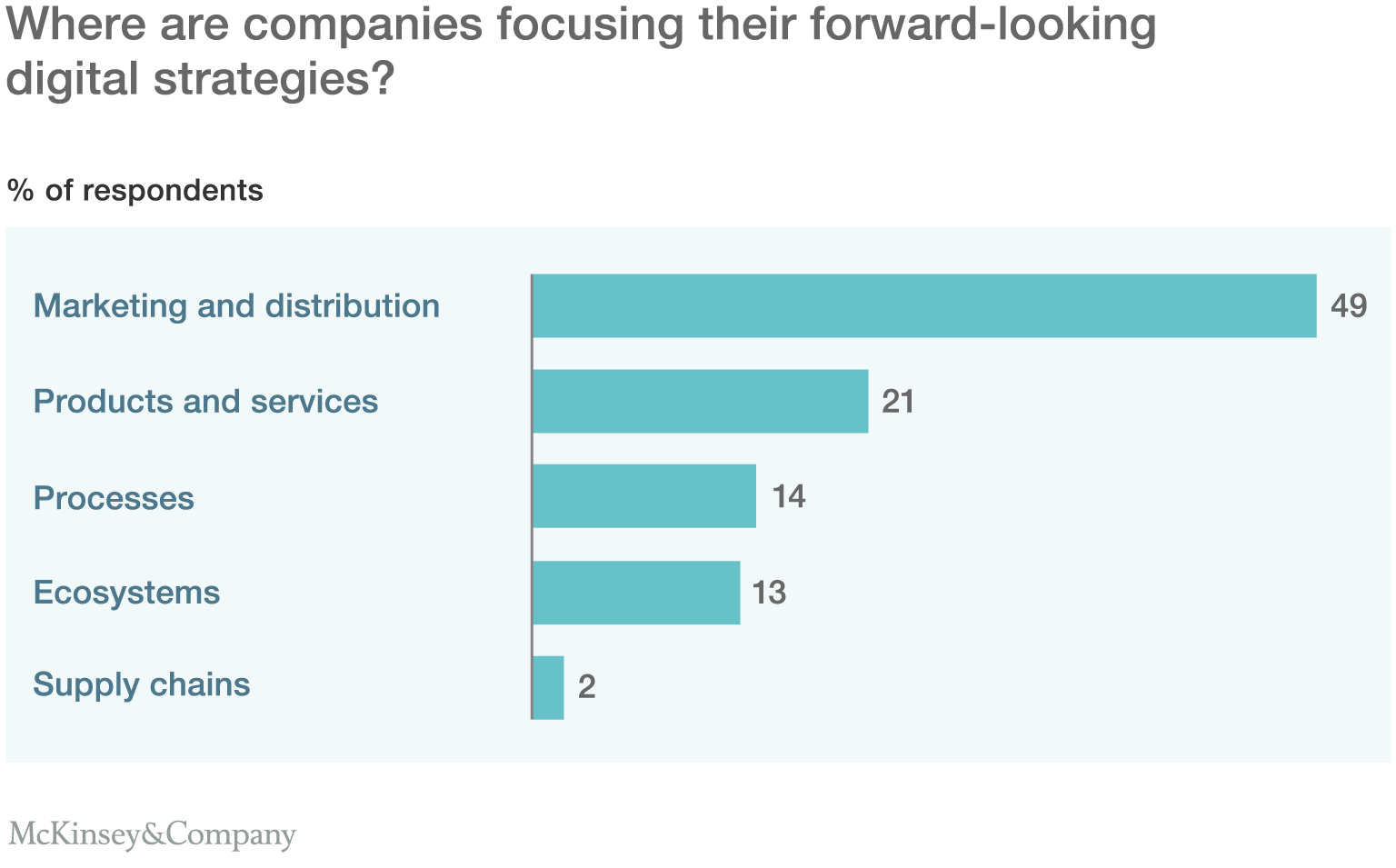

Yet despite this potential impact, survey respondents report that in making digital investments, their company’s attention is mainly on other functions. Only 2 percent, in fact, report that supply chains are the focus of their company’s forward-looking digital strategies (Exhibit 2).

Today’s capability constraints are part of the reason progress is slow. A McKinsey Global Survey of more than 900 C-level executives found that talent shortages top the list of challenges companies face in meeting their strategic digital aspirations.

To drive digital supply-chain transformations, supply-chain leadership must combine traditional functional and leadership capabilities with new technical skills that span data, algorithms, and technology. And they need to understand more than just what these innovations are: they must also understand whether—and how—they create real value for the businesses they are supposed to support.

But our research shows that few organizations have these skills. Accordingly, just adding new digital and analytics talent won’t be enough to achieve a successful transformation.

Consider the experience of a leading consumer-goods company. Committed to innovation in Supply Chain 4.0, it hired a group of data scientists to help it set up a more data-driven supply-chain strategy. The organization also wanted to assess its current capabilities, to find gaps that needed filling and strengths that needed leveraging.

When benchmarked against an industry capability database, however, the data scientists were found to lack an end-to-end understanding of supply-chain management. That shortcoming left them unable to solve many of the inherent trade-offs among sales, planning, and operations. Moreover, despite deep knowledge in functional areas such as demand and supply planning, the entire talent pool had only a few end-to-end experts—people who could translate supply-chain and business requirements into digital projects and then validate the proposed solutions. Consequently, an extensive training effort was needed to help both veteran and new talent make algorithms and technology effective in solving real business questions grounded in supply-chain realities.

Our capabilities are generally strong in finance and marketing, and we shouldn’t accept anything less in supply chain. This is an industry-level issue, not just in our company.

First, strengthen supply-chain competencies

How skilled are your supply-chain people? Quite possibly less than they should be. Our work with organizations in assessing and benchmarking supply-chain capabilities allows us to observe strengths and gaps in mastering both traditional supply-chain topics and, based on that foundation, digital readiness. Using a psychometrician-validated tool, we assess eight core domains: supply-chain strategy, order and demand management, forecasting, inventory management, production planning, supply planning, operational logistics, and performance management. The results enable baselining of skills, industry benchmarking, and measurement of training programs’ success. Organizations can also use the findings to pinpoint areas of strengths to leverage, or to design tailored capability-building interventions.

The data from more than 7,000 respondents point to several talent-management and organizational findings that together help make digital supply-chain transformations smoother.

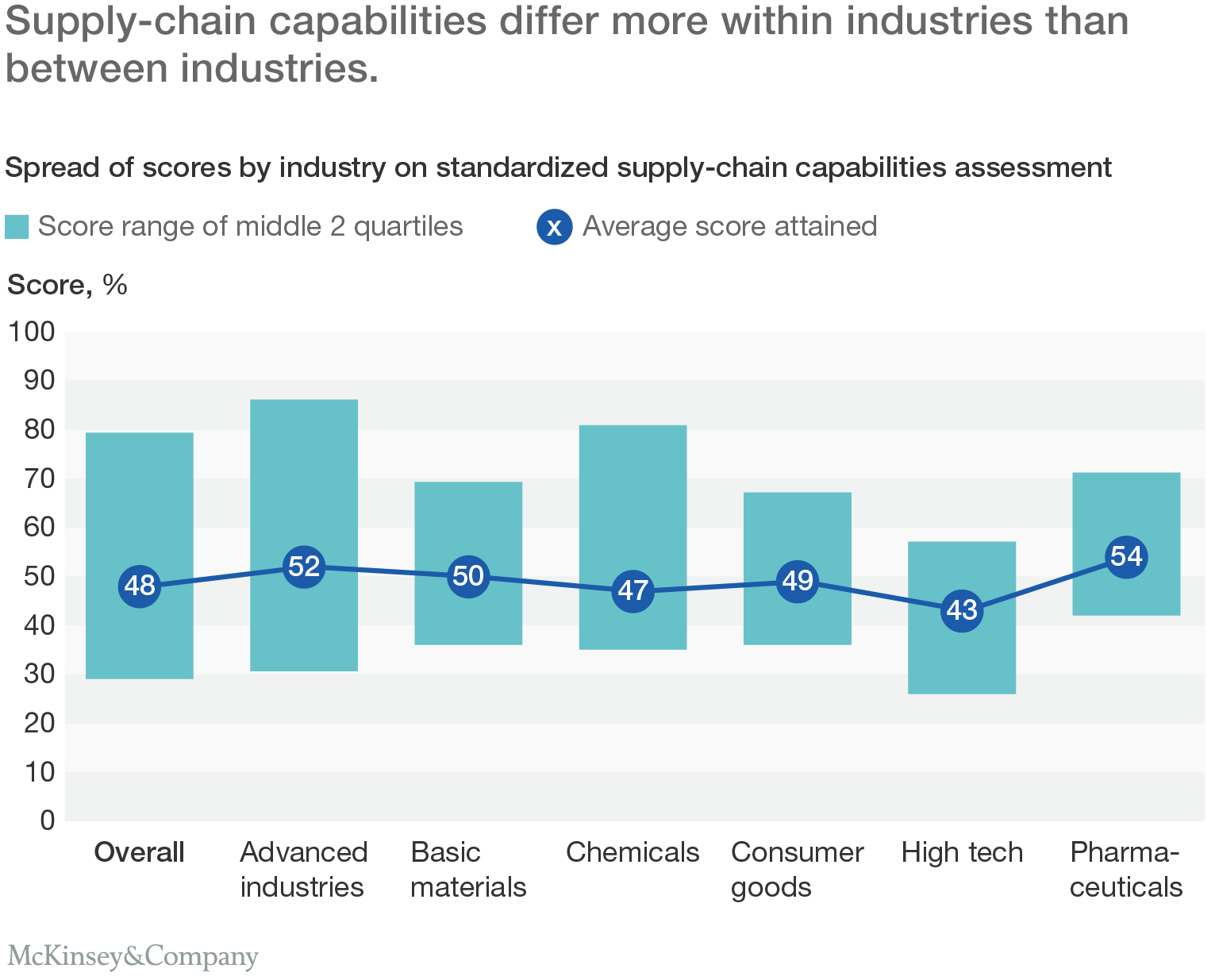

Look for talent outside your sector

Across industries, companies’ average scores cluster within a tight 10-point range on a scale of 100, centered at about 48 percent. That finding validates the view that supply-chain knowledge is transferable across industries (Exhibit 3). But within a single industry, the range of skill levels is generally large, indicating that attracting and developing top talent are factors that an organization can influence.

In practice, organizations can apply these findings in several ways. First, they can be more strategic in their recruiting by looking past sector constraints for fast learners with strong supply-chain accomplishments, regardless of industry. Next, they can increase supply-chain experts’ effectiveness by expanding their capabilities, particularly in supporting actual business needs.

At the organizational level, one option is to build a central supply-chain unit with an end-to-end mind-set and top skills in service-level attainment and delivery management. Another is to focus more narrowly on developing logistics expertise among warehouse and transportation-management staff, so they become the operational efficiency engine. Finally, better performance management across the board—rewarding the top performers and taking corrective action when performance drops below expectations—helps turn talent into a supply-chain organization’s central strength.

Organization-design choices can narrow or widen access to top talent

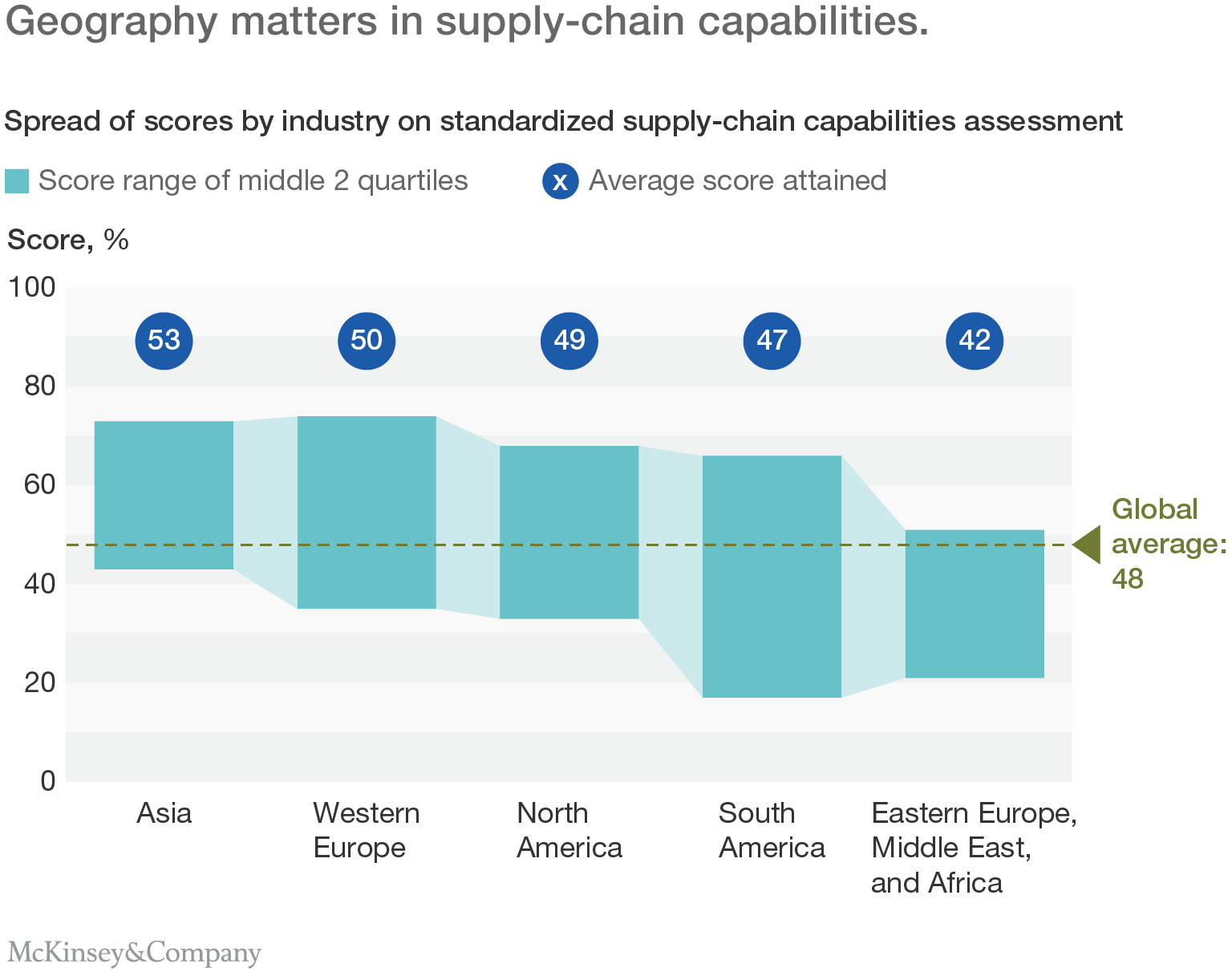

Supply-chain management may be a global skill, but worldwide talent pools have different skill profiles. The assessment data show the highest concentration of supply-chain experts is in Asia, followed by Western Europe and North America (Exhibit 4).

A supply-chain function’s geographic footprint therefore matters. On average, the function may have good skills, but a deeper look at their location and mix may reveal weak links. A pharmaceutical manufacturer found that although its supply planners were better skilled than average compared to global benchmarks, they were less skilled than average for the specific region where they were located. The initial implication was that the company wasn’t recruiting or retaining the best talent available. On deeper analysis, the leaders realized a more important lesson: they were using the regional hub for wrong purpose, relegating it to transactional supply management even though the local talent had end-to-end skills that could create more value for the central supply-chain group.

Career pathways also matter. A consequence of lower organizational capabilities in supply chain is that in many organizations, top management comes from other functions: R&D, production, sales and marketing. The pattern becomes self-reinforcing, as high performers move into areas where they think they can better fulfil their potential, and leaders without supply-chain experience stop investing in developing the supply-chain organization’s capabilities. Supply chain is left as a planning and execution function.

Capability building pays off

Regardless of the talent market, organizations that invest in developing their people while launching a transformational change program see a higher success rate than those that do not—by a factor of up to fourfold. Supply-chain performance also correlates strongly to staff capabilities; in general, good capability builders generate twice as much EBITDA as other organizations.

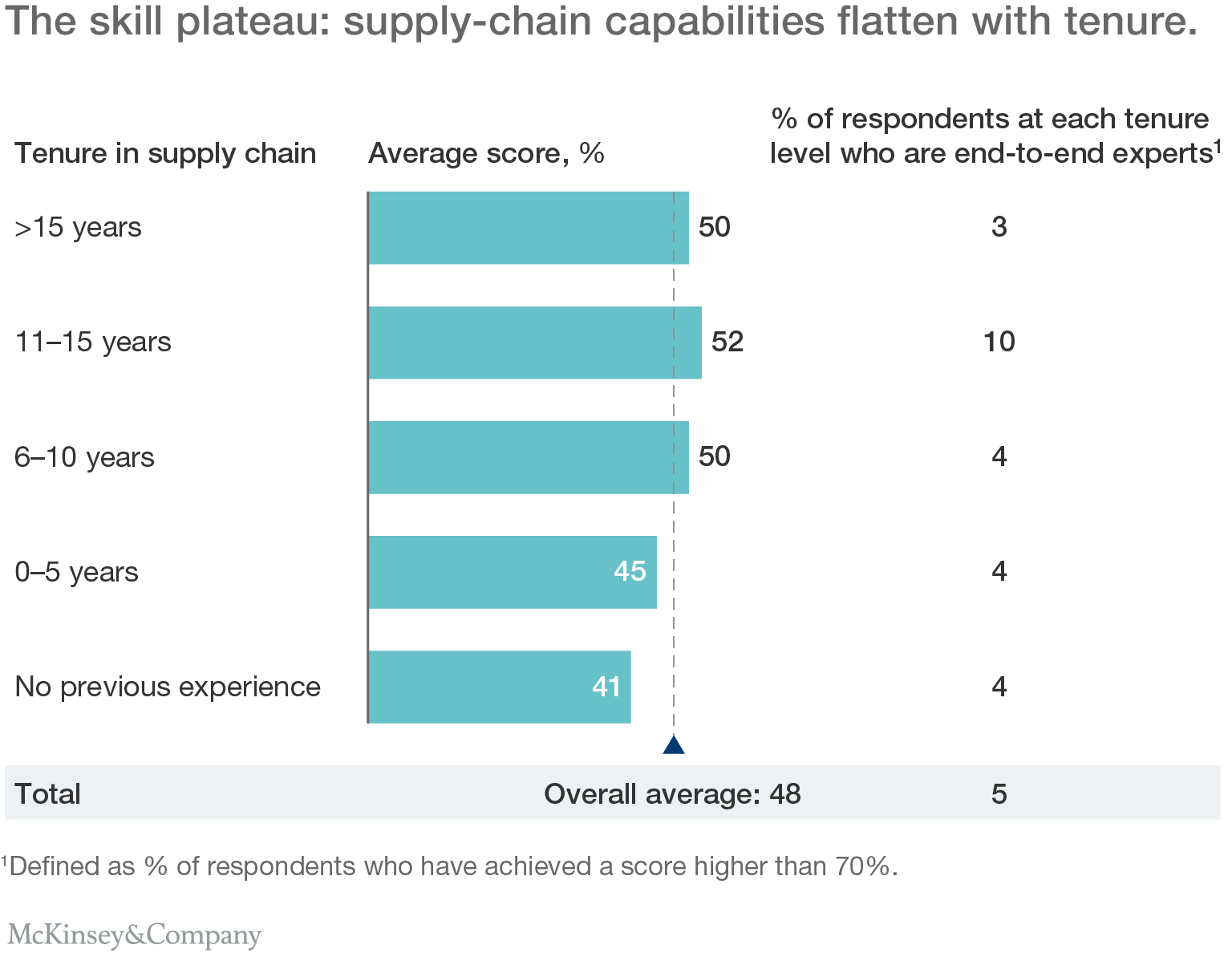

But our data show a surprising gap in supply-chain capability building: among the longest-tenured staff. As expected, expertise generally accumulates with experience—until just after the 10-year threshold, where skill profiles tend to flatten out (Exhibit 5). That suggests either that high performers leave (whether into lateral openings or leadership roles), or that organizations invest less in the training and development of experienced professionals. Yet particularly during a transformation, higher-tenured people need training and support from a change perspective, so that they stay engaged and help develop and adopt new ways of working.

One global manufacturer illustrates the potential from capability building. It recently transitioned from a traditional hierarchical, centralized organization to many smaller, independent, cross-functional business units, each dedicated to a customer segment. The change has been supported by intensive cross-functional capability development, with a focus on end-to-end order fulfilment, while also strengthening top performers’ leadership skills. The combination of four factors—greater autonomy, an end-to-end mind-set, deep understanding of the implications of segmentation, and relentless focus and accountability for order flow through the supply chain—reduced order-to-fulfillment lead times by over 70%.

Where are the end-to-end experts?

In the average organization, we find that about 60 percent of supply-chain professionals have an expertise spike in just one area of the supply chain. End-to-end experts—whose well-rounded mastery is most likely to meet tomorrow’s requirements—are thin on the ground, accounting for only about 5 percent of all supply-chain roles, typically in subfunctions such as supply-chain excellence or analytics. The remaining staff are not meeting the bar in any area of supply-chain management.

Prepare for new roles with enhanced capabilities

In the short term, automation and digitization will create more roles for data scientists, analytics engineers, and IT and big-data specialists, who bring new knowledge to the supply-chain organization. But to produce lasting results, this new talent will need training in supply-chain management, or support from "translators" who blend functional and digital knowledge.

Once people are knowledgeable about supply-chain realities and have sufficient end-to-end expertise to support integrated business decisions, organizations can start preparing for the gradual digitization of the supply chain. The mid- to long-term will likely see organizations in a more advanced evolution: no longer mixing new and old roles, but redefining capability requirements and skill profiles in each supply-chain subfunction:

- Planning will need people able to work with complex data sets (whether internal or external to the organization) and quickly apply advanced algorithms, such as predictive analysis, dynamic optimization, and machine learning, in identifying and exploiting demand and supply patterns.

- Physical flow and logistics will increasingly rely on in-house logistics experts whose grasp of warehouse-design principles and automation technology gives them deep insights on practical applications. Network optimization decisions will be led by functional specialists with in-depth skills in adding and shaping constraints in software environments. Cross-functional teams of experts in logistics, purchasing, and supply-chain clean-sheets will guide logistics sourcing. And advanced analytical capabilities and optimization expertise will allow transport planners to challenge transport-management systems providers more effectively, and co-develop tailored solutions with them for company-specific requirements.

- Customer service and engagement levels will increase as customer-centric designers create automated order- and customer-management processes, moving customer interaction and engagement to digital channels.

- Strategists taking advantage of platforms for data sharing, analysis, collaboration, and logistics-services delivery will push the organization’s thinking and aspirations, creating new revenue streams through the supply chain.

Overall, better cross-functional communication and leadership skills will strengthen collaboration with both the R&D and sales and marketing functions, for integrated execution from idea to market. Accordingly, in preparing for digital transformation, the crucial task is to prepare people for the single most valuable human role: managing the supply chain from end to end across internal boundaries.

How to do it: Building capabilities before and during a supply-chain digital transformation

A thoughtful approach to the design and deployment of capability building will make the transition to the next generation of supply-chain operations easier. A couple of guiding principles help foster support and adoption of the changes: first, focus on delivering the supply-chain strategy, and second, reach beyond digital and analytics champions to the organization at large.

The training process then moves through three stages:

- Diagnose. To understand its starting point—the gaps to fill and strengths to leverage—the enterprise must assess individual and collective skill levels against business and supply-chain objectives as well as external benchmarks. Self-assessments, outcome-based tests, internal project-based competitions, and calibrated interviews can all support the diagnosis of current capabilities.

The results will identify existing experts in the organization, who can then serve as facilitators, coaches, or designers of the capability-building effort. If internal talent is lacking on a topic—whether traditional or related to Supply Chain 4.0—hiring new talent can be part of the solution. - Design. Next comes the design of a capability-building curriculum and the planning of learning journeys. Many of the core Supply Chain 4.0 concepts, such as big and open data, the Internet of Things, intelligent automation, virtual and augmented reality, remain mysterious to today’s supply-chain professionals. But experimenting with these new technologies can expand people’s horizons, increase learning retention, and inspire innovation.

Accordingly, inspirational learning journeys are at least as crucial in digital and analytics as they are for other types of skills. The journeys should be based on adult learning principles, including hands-on experimentation in realistic environments. Games and role-plays help develop problem solving-skills on supply-chain issues, while model factory or warehouse settings effectively teach lean and digital-operations management. A field-and-forum model—which coaches people on how apply the lessons they have learned in the classroom, using assignments that are tied to actual work projects—translates the classroom experience into the day-to-day.

One company built its people’s engagement in new practices through a hands-on, competitive project designed to encourage global crowdsourcing of analytics solutions. Staff got the opportunity to define concrete problems, break them down into testable components, and use crowdsourcing platforms to reach the right talent pools worldwide. After several rounds of competition, people became confident enough to see crowdsourcing (and external collaboration in general) as a practical way to solve problems, rather than an abstract buzzword. - Implement and sustain. Learning does not happen in isolation. At the same time, a capability-building program must precisely identify critical skills (in some situations, down to the individual level) and enhance them in a targeted way. To balance these two pressures, a delivery mechanism that scales is essential.

Well-structured field-and-forum programs can fit the bill, but the curriculum must cover more than just classroom-based learning sessions or even experimental setups. Program designers must also select well-defined, small-scale problems that participants can realistically solve and implement as part of their learning journeys. Once a solution is tested and validated, it can be implemented; if it fails, the lessons carry to the next project. That learning cycle builds people’s problem-solving capabilities. Some of the more successful participants can then be certified as trainers or coaches, building the ranks of capability builders and the scale of the entire program.

Of course, the program’s successes won’t last for long if the organization fails to celebrate a learning culture. Beyond the start and end of a defined program, the organization should foster self-learning, such as through periodic workshops with subject-matter experts, industry partners, and startups. Likewise, formal tracking and reporting mechanisms—measuring progress not only in course and project completion, but also in performance on actual business indicators related to the new skills—reinforce the cultural importance of acquiring new skills.

For too long, capability building has been a noble aspiration, but one that’s been executed with scant connection to business outcomes and little proof of impact. The cross-functional impact of supply-chain management raises the knowledge bar still higher. With looming challenges from digital transformation, that organizations that build new strengths both in technical skills and in end-to-end perspective will be best equipped to win in the new competitive landscape.