To many consumers, the decision to drive an electric vehicle (EV) will hinge on the promise of a high-quality, high-capacity battery powering the engine. As such, the large-scale arrival of EVs on the main stage of global vehicle sales will be predicated on significant acceleration of EV battery production and capacity.

In the European Union, total annual battery capacity will need to scale from the current 60 gigawatt hours (GWh) to 900 GWh to meet the European Union’s 2030 decarbonization targets. McKinsey Partner Evan Horetsky helped plan and build all of Tesla’s gigafactories in China, the United States, and most recently in Berlin, Germany, where he served as the director of engineering, procurement, and construction. He spoke with us about the role of gigafactories, breaking down organizational silos, and prioritizing decarbonization of the supply chain.

McKinsey: What are gigafactories, and what role will they play in achieving Europe’s decarbonization targets?

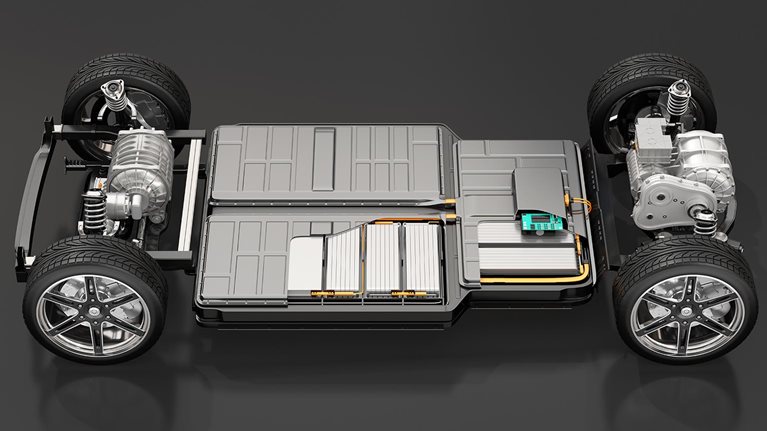

Evan Horetsky: There are two definitions of gigafactories, both of which are relevant to Europe’s decarbonization targets. The first is to think of a very large-volume factory as a hardware product itself—that is, applying all the technique and rigor normally found in product design and engineering to manufacturing and factory design. In this way, gigafactories will shape every area of future industrialization, prioritizing electrification, sustainability, and digital, as well as operative efficiency. The second definition is, more simply, a large battery factory—and battery production will be key to unlocking the energy storage, grid utilization, and future mobility strategies we need to achieve decarbonization.

McKinsey: What considerations are required to successfully expand Europe’s annual battery capacity?

Evan Horetsky: The organizations building the more than 30 planned battery factories today need to think about several nuanced and difficult questions. These include what generation of cell technology to apply to their line planning, how to be flexible with changing customer specs and recipes, and how to carefully manage equipment, raw materials, and other long-lead items. All of these considerations will be crucial to ensure organizations do not get caught off guard with delays closer to launch. For example, Northvolt has invested heavily in lab and pilot-plant validation as well as in advanced simulation and process-validation techniques for both the product and the factory. These investments enabled the battery developer to roll out a new plant in Skellefteå, Sweden, very quickly.

Voices on Infrastructure: Scaling EV infrastructure to meet net-zero targets

McKinsey: Is there now a strong business case for investing in battery gigafactories, or are additional regulations and incentives required to attract investors?

Evan Horetsky: The margins are tight, and the scale needed to meet demand is intense, with some projecting that more than 3,000 GWh per year will be required by 2030 in order to displace the more than 70 million internal-combustion engine (ICE) vehicles produced annually. Because yield and scrap rate are such outsize factors in the probability of success—and ramping up cell manufacturing is so darn hard—government regulations and incentives could help support risk-taking in this period of ramp-up and scale.

McKinsey: What partnerships and commitments are required to scale battery capacity at the required pace?

Evan Horetsky: Products must be synthesized with manufacturing equipment, which must in turn be synthesized with factory decisions. Breaking down the walls between R&D, manufacturing, and building-construction data and efforts is crucial for a successful plan. Beyond this, precise forecasting and strategies are needed to secure long-lead materials and equipment. We also need to make a commitment to employees and talent, recognizing that they must sacrifice a lot to push through one of the most unforgiving production ramps in any industry.

McKinsey: How are car manufacturers collaborating with battery manufacturers and EV charging-infrastructure providers to collectively grow the market?

Evan Horetsky: Because there is a large and varied set of bottlenecks in the supply chain for electrification, OEMs and their suppliers are working in varied ways. With charging via either infrastructure or batteries, it is quite important to understand real estate, regional utility business, and power electronics. In some cases, like Volkswagen’s Electrify America, OEMs are creating new businesses to serve this need. Others, like Tesla, are going their own way—and their developments could prove to be a key competitive advantage.

McKinsey: What key improvements can we expect from battery electric vehicle (BEV)batteries in the next three to five years, such as performance, cast, or carbon footprint?

Evan Horetsky: A zero-carbon supply chain is the first priority. After that, thermal efficiency and cell-to-pack density efficiency can do a lot to drive further improvements in EV architectures. Pack-density efficiencies must reach beyond 80 percent, and direct current internal resistance below 10 milliohms is needed to realize thermal-system efficiency. After this, cell chemistries with faster charge and power discharge will be developed. Solid-state products are very tricky to scale, but they could also double mass density of cells over the next few years.

McKinsey: What is the biggest sustainability challenge facing electric vehicles, and how do we mitigate it?

Evan Horetsky: Supply chains. All areas of the supply chain will present significant bottlenecks, so that will constitute the primary sustainability challenge for electric vehicles. Otherwise, the goal to advance to sustainable energy is incomplete. Decarbonization can be achieved through recycling and circular methods, as well as through agility in product bills of materials—swapping in more sustainable materials when possible. Safety and toxicity are also quite important, and there are alternative techniques for processing and selection that need to be employed, like direct lithium extraction, to improve manufacturing safety.

Comments and opinions expressed by interviewees are their own and do not represent or reflect the opinions, policies, or positions of McKinsey & Company or have its endorsement.