Many large companies are supreme revenue generators, reflecting their ability to create excitement around their offerings and consistently meet their customers’ needs. When it comes to managing their financial resources, however, they are often less successful. Many struggle to maintain a strong, real-time grip on their finances and, as a result, leave significant value on the table.

Suboptimal financial resource management is rarely the result of a single policy or decision. Rather it is the by-product of entrenched ways of working that, over time, undermine a company’s financial regime. Such suboptimal management usually manifests in one, or several, of five areas of activity: funding and capital structure, liquidity (cash) management, capital productivity, risk management and contingency planning, and, where relevant, commodity-related strategy. Inefficiencies in these areas directly undermine financial performance. In an age of shareholder activism, they also leave executives exposed. Shareholders expect companies to be demonstrably at the cutting edge of financial engineering. When they see a deficit, they are increasingly likely to make their voices heard.

Underperformance in the management of a company’s financial resources is a common challenge. However, it is addressable, if leaders prioritize the tools and processes necessary to make a difference. Chief among these are the latest analytical resources, which can enable more consistent modeling, better responsiveness to economic and geopolitical events, closer adherence to key performance indicators, and a sharper view of capital expenditures. Cutting-edge analytics, combined with a holistic approach across the five areas of activity, compose powerful levers to transform financial resource management into a significant source of opportunity.

CFOs face multiple challenges

Financial resource management sits alongside a range of responsibilities that fall under CFO remit, including value steering and control, portfolio management, risk management across products and business lines, value communication, activist-threat management, and operational excellence in the finance function. Within financial resource management, a CFO’s charges are balancing priorities and resources across the balance sheet and capital structure, managing liquidity and cash, and optimizing the company’s risk position. None of this is easy. A common CFO refrain is that they “always could get something wrong,” whether that be insufficient or excessive hedging, matching funding to capital-expenditure priorities, or holding too much cash at a negative carry. There is also a very consistent sense of struggling to meet the demands of competing interests, both internal and external.

In funding and capital structure management, a CFO has the constant challenge of achieving a funding mix that reflects the company’s strategy at a particular moment in time while maintaining financial flexibility and keeping the weighted average cost of capital at a reasonable level.1 There are plenty of theories as to optimal levels, and CFOs often face a challenge in justifying their positions.

Would you like to learn more about our Risk Practice?

With respect to managing liquidity, CFOs must weigh a precautionary attitude based on current resources against the instinct to pursue value creation. Right now, for example, many companies are sitting on cash accumulated through years of profitability and postcrisis caution. Despite rising investment and stock buybacks, the average cash holdings of the world’s top 25 nonfinancial companies remained a near-record high of $43.6 billion in 2018, according to Moody’s Investors Service. However, it’s tough to find the right balance. Activist investors often challenge companies which accumulate excessive case balances without an apparently good reason. On the other hand, there are countless examples of “buccaneering” ventures that end up on the rocks.

Capital allocation that does not take into account the impact of an investment on a company’s risk profile and risk management is a significant source of jeopardy.2 The fact that companies lack comprehensive project maps and criteria to evaluate opportunities consistently, leading to a sense of randomness in decision making, often exacerbate exposures.3 A rush to “get the deal done” can lead to ignoring changes in a company’s risk profile over time. This stems from the lack of an integrated view of exposures across business units and inconsistent measurement and reporting of financial risks.

When it comes to foreign exchange (FX) and interest rate risk management, hedging programs are often too generic, while alternative approaches, such as natural hedges, are missed. Very few companies effectively align their hedging strategies with definitive levels of risk tolerance. It is common to see rules of thumb applied—for example, hedge a certain percentage of cash flows. These kinds of assumptions can lead to low hedge effectiveness, margin compression or over-hedging, and a loss of competitiveness as a result of favorable interest rates, exchange rates, or commodity prices.

Finally, commodity price and risk management often occur outside the ambit of an end-to-end risk management approach, particularly among large commodity companies, making commodity hedging less effective.4 To add to the challenges, the financial aspects of managing companies’ carbon footprint are often ignored when funding and risk management decisions are made.

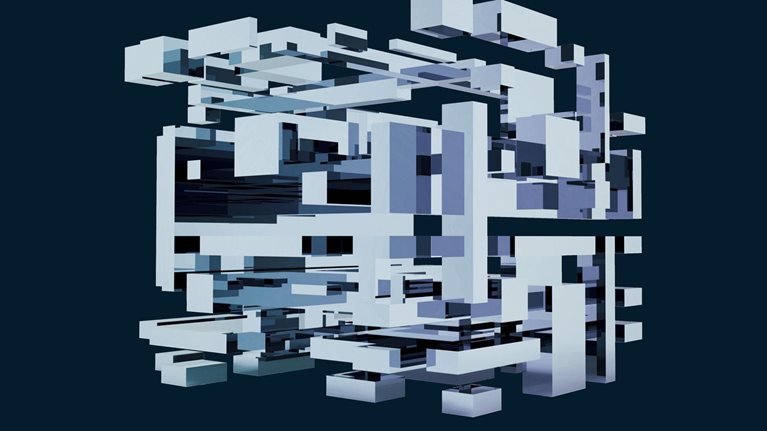

Companies should optimize across five elements

CFOs can create value by optimizing their financial resource management approaches to the five key areas of activity, represented by the segments of the pentagon in Exhibit 1. However, they can achieve more substantial, or even game-changing, impact by taking a holistic approach. That means leveraging advanced analytics to unlock insights across the segments, or at least the majority of them, and using that information to make cross-cutting decisions.

Companies must make qualitative and quantitative assessments of the state of the play. However, a historic-, interview-, or dialogue-based assessment is insufficient. Rather, they must embrace comprehensive modeling that focuses on forward-looking simulations. The simulations should model each relevant element of the pentagon along a large number of scenarios, including stress cases, bearing in mind that changes in one element will invariably affect another—additional leverage, for example, is likely to modify risk management policy.5

Sophisticated multifactor modeling, applied holistically, can unlock insights that embrace all of a company’s financial positions. It can also help improve forecasts and risk communication protocols, helping CFOs explain and justify financial management strategies. In areas such as FX, interest rate, and commodity risk management, this can lead to a more realistic view of underlying exposures. CFOs can then act to take out inefficiencies. In capital management, companies can test their assumptions with respect to target leverage and consider how alternative balance-sheet structures may affect borrowing costs.

Company and industry circumstances, which change over time, uniquely drive each element in the financial resource management pentagon. Therefore, incremental adaptions and improvements are likely to be insufficient. A holistic approach, on the other hand, can create a multiplier effect that feeds directly to value creation. Very much as seen in investment, in which diversification is a standard theoretical paradigm, optimizing across multiple elements can allow companies to lift returns without increasing risk exposures. This means being able, and willing, to make changes across funding, risk management, and capital allocation. More granular analyses of capital allocation, for example, can precipitate balance sheet restructuring that frees up strategic liquidity for investment.

A primer in resilience: Maximizing value beyond earnings

Still, one size does not always fit all, and companies can also make significant gains by focusing on specific areas of activity. One top-tier automaker unlocked annual savings of $15 million by reducing balance sheet hedging by 50 percent (without a shift in risk appetite) and converting part of its FX forward-based hedging program to out-of-the-money options.

A leading infrastructure company, meanwhile, deployed a holistic approach to address a surfeit of cash on its balance sheet and significant exposure to foreign exchange markets (Exhibit 2). This involved using advanced techniques to create probability models for a range of factors and taking into account uncertainties, such as cyberrisks and data risks. The company’s analysis showed that its liquidity buffer of $2.2 billion was excessive and that, in fact, it required just $1.3 billion of liquidity to maintain resilience and strategic flexibility. It used the outstanding $900 million to repay a maturing bond, reduce hedging costs, and boost its dividend. It generated additional savings by swapping $500 million of fixed-rate debt to a floating rate. The combination of these actions contributed to a 15 percent increase in the company’s valuation over a year.

The arguments for holistic financial resource management are compelling. However, there are also sound performance metrics behind the theory. Companies that reallocate resources (including financial resources) most aggressively (41.0 to 100.0 percent) achieve 10.2 percent growth in total returns to shareholders, compared with 7.8 percent for companies that reallocate 20.0 percent or less.6 Over 15 years, this implies a 40 percent relative valuation uplift.

Holistic transformation, assisted by advanced analytics and modeling, can be a game changer in corporate financial resource management. Effectively implemented, it can generate a seamless view of a company’s key future financial position. Rarely will all five elements identified in this article be equally relevant; leaders must pick and choose (perhaps two or three), according to their own strategic agenda. In most cases, a holistic approach will require trade-offs between the various risks and commitments in focus. However, successful transformations are likely to boost financial transparency, support a nimble approach to management, and create a significant boost to the bottom line.