The argument for global companies to reduce their greenhouse-gas (GHG) emissions is clearer than it has ever been:

- Business operations around the world are now subject to greater climate and transition risks.

- Consumers are clamoring for eco-friendly products and responsible corporate behaviors.

- Investors are increasingly embracing capital-allocation strategies that take environmental, social, and governance (ESG) issues into account.

- Policy makers and government organizations are exploring the potential regulation of carbon emissions.

In response, organizations across all industries have declared GHG-emission-reduction targets—including for some a “net-zero commitment,” in which a company ensures that emissions from its value-chain activities create no net climate impact.

In 2020, more than 4,500 companies worldwide self-reported their GHG emissions for public disclosure, and about 40 percent of those companies have committed to specific emissions targets as part of their strategic and financial plans.1

What about the companies that haven’t—what sort of goals should they set? To find out, we reviewed the 2020 data on disclosing companies’ carbon-emissions targets. We wanted to see which companies and industries seem to be on track to meet their goals and how they got there.2 Among our observations: the more aggressive the targets, the better the results.

Time and scope are critical factors

Our analysis shows that 44 percent of the organizations that are currently disclosing their GHG emissions are focused on short-term targets—that is, they are aiming for emissions reductions by 2025. Twenty-seven percent of the disclosing companies are focused on medium-term targets (with reductions by 2026 to 2040), while 2 percent are focused on long-term goals (with reductions by 2031 to 2050 or later). The remaining 27 percent of organizations have set targets across all three time horizons.

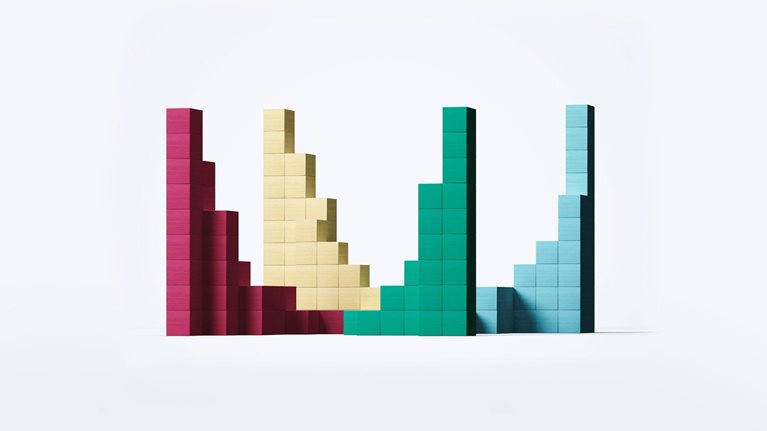

Most of the disclosed targets (74 percent) are from companies trying to reduce GHG emissions that are closer to the core—that is, from sources they own or control (Scope 1 emissions) and from the generation of the electricity, heat, or steam that they purchase (Scope 2).3 By contrast, only 26 percent of the targets are aimed at reducing Scope 3 emissions, which are not directly owned by the business but are related to its activities—in air cargo or supply chain, for instance (Exhibit 1). That is likely because Scope 3 emissions are much more challenging for companies to track and control. However, in our experience, it is worth the effort to do so: Scope 3 emissions can account for more than 50 percent of a company’s total GHG emissions.

Some industries are more on track to achieve targets than others

Our analysis also shows that nearly 65 percent of the disclosed targets are on track to be achieved between 2020 and 2050. As might be expected, the companies that are above average in meeting their GHG-reduction targets are in industries that tend to be less extractive—the apparel, infrastructure, manufacturing, power-generation, and services sectors, for instance. Within these industries, however, some companies are still lagging behind in achieving the targets they disclosed. The message to above-average companies, then, is to continue their decarbonization efforts and stave off complacency.

The companies that are below average tend to fall in one of several categories: they are in more-extractive industries (such as agriculture and fossil fuels) or in sectors that are harder to decarbonize (such as transportation), or they simply have a lower number of disclosures about target setting. These companies must contend with, among other factors, fragmented supply chains, heavy machinery, high carbon use, and the lack of viable economic alternatives that would allow them to decarbonize unilaterally (Exhibit 2).

For most industries, at least 50 percent of their emissions-reduction targets are on track, according to our research. But a closer look at target time frames reveals that industries that are on track with their short-term targets (2020–25) tend to stay on the rails and, in many cases, are projected to perform well with their targets over the longer term.

Four industries proved to be the exception, facing relatively more challenges with meeting their long-term targets even when performing well in the short term: transportation, fossil fuels, hospitality, and healthcare and biopharmaceuticals. A key factor in these industries is the role of technology in reducing GHG emissions. Long-term decarbonization efforts in both transportation and fossil fuels, for instance, will require significant technological breakthroughs—alternative fuels, electrification of heavy-duty vehicles and commercial aviation, carbon-capture-and-storage technologies—as well as a commitment to execution. Of course, technologies to reduce carbon emissions are generally available to companies in hospitality and healthcare and biopharmaceuticals, but here a commitment to execution will be critical.

Aggressive targets may improve performance

Additionally, we found a positive correlation between companies’ average targeted percentage reduction of emissions (relative to the base year) and their progress at the time of reporting.4 In other words, companies with more aggressive targets appeared to overperform on the path toward achieving those targets. This trend holds true even for carbon-intensive industries such as materials, manufacturing, and power generation (Exhibit 3).

Implications for target-setting companies

In total, the data suggest several things for companies seeking to set targets for GHG-emission reduction. First, don’t forget targets that seek to reduce Scope 3 emissions, as alongside Scope 1 and Scope 2 emissions, they too make up a big part of the total carbon footprint of an organization. Second, recognize that success today in hitting emission-reduction targets is a good predictor of future success. And finally, remember that businesses that set bold targets are more likely to make more headway against them.

The very exercise of setting carbon-reduction targets can be an important step for organizations; it presents both risks and opportunities to create value from decarbonization. Throughout this exercise, then, executives should consider how or whether the company’s carbon-reduction efforts can help differentiate it from competitors; and they should be intentional about shorter-term targets for 2025 and 2030, as those targets will be critical for mobilizing the organization to act.