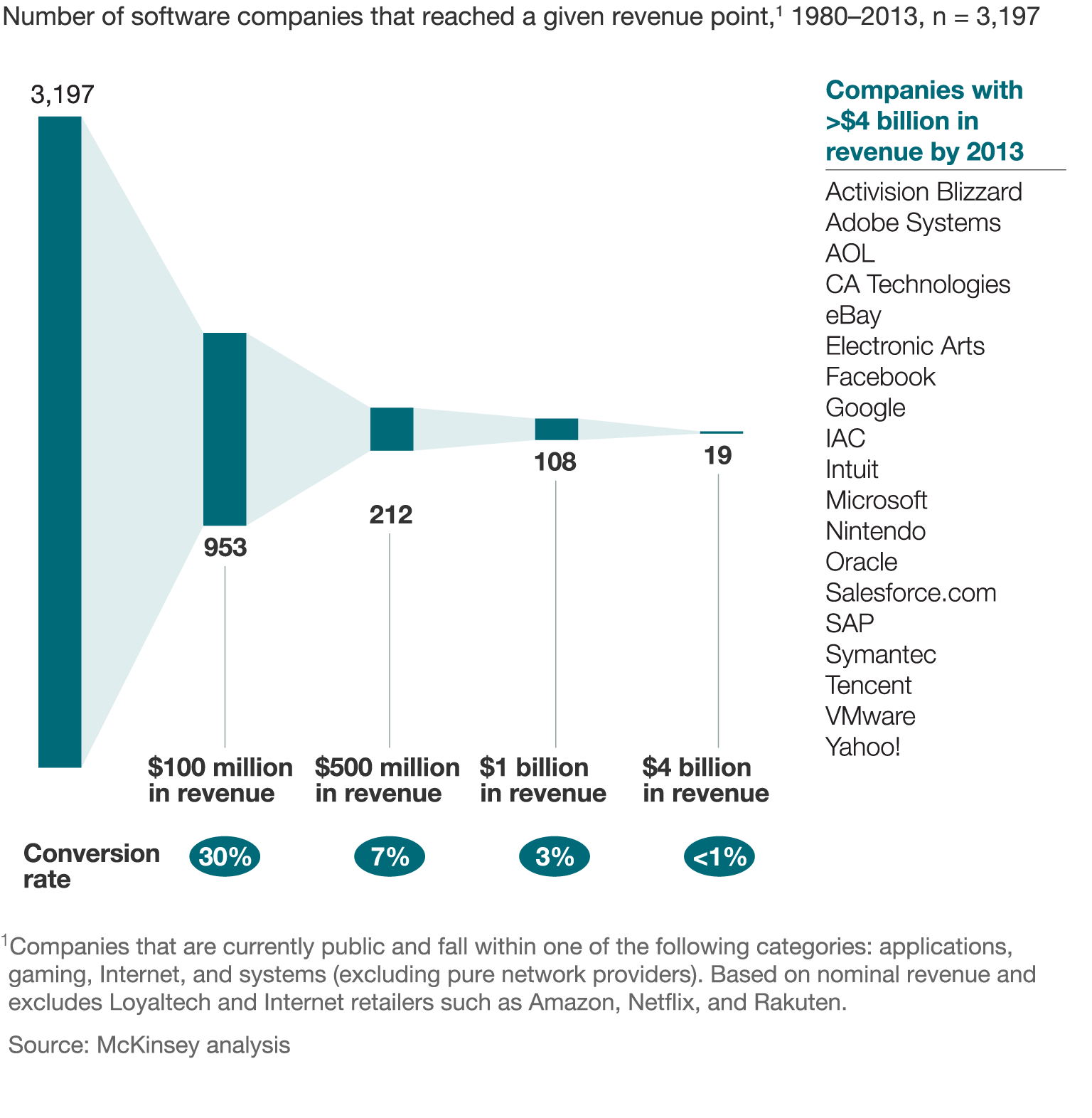

Software companies must constantly evolve and capture new growth opportunities or risk slowly declining into irrelevance. Only 3 percent of start-ups grow into companies boasting annual revenue of at least $1 billion.1 Yet that achievement is only the end of the beginning. Act II involves developing into a multibillion-dollar company, and the odds are slim: our latest research shows that of the 3,197 public software companies launched between 1980 and 2013, just 19 have reached $4 billion in annual revenue (Exhibit 1).

Fewer than 1 percent of software start-ups reach $4 billion in annual revenue.

We’re not suggesting that “only” having revenue of $1 billion annually is a problem or that all companies aspire to get larger and larger. Yet no company can afford to stand still. Business leaders often struggle to determine when, where, and how to move their organization beyond its initial growth spurt. Through our research into the role of growth and our extensive work in the software sector, we’ve identified four lessons:

- All companies need a second act. As companies scale, they periodically need to look beyond their core business to identify new sources of growth. How soon depends on the size of the core market and the speed of market saturation.

- Emulate the best. We’ve found three models of success that companies can emulate: rocket ships, adjacency buyers, and reinventors.

- Timing is critical. Moving too early will detract from Act I, while moving too late will stall the company. Companies that successfully navigate Act II employ “headlights” to pinpoint the right time to move.

- Keep your balance. The right growth market isn’t necessarily the largest or the fastest growing or the most adjacent. Successful companies strike a balance between aspiring on attractiveness and anchoring on familiarity.

Grow fast or die slow

Understanding the unique management challenges facing fast-growing technology companies.

1. All companies need a second act

Our previous research highlighted the importance of achieving and maintaining high growth rates in software and online services. In fact, we found that fast growth is the best indicator that a company can beat the odds: organizations that are “super growers,” with revenue rising at a compound annual rate of more than 50 percent, are eight times more likely to reach $1 billion in sales than those growing at less than 20 percent annually. We believe this rapid pace of growth is essential to survive the hypercompetitive gauntlet of software and online services. (See “The reality of growth: Synopsys CEO Aart de Geus,” a video excerpted from three interviews with Silicon Valley CEOs on the issue of sustaining growth. For more, see “The reality of growth in the software industry.”)

We also know that software companies cannot be one-trick ponies. While they typically enjoy an initial wave of fast growth in markets they enter or create, they eventually hit a wall. In the best-case scenario, the market matures and growth is limited by overall macroeconomic conditions. In the worst case, companies face disruption and rapid decline. And even though organizations can press for a dominant share of a specific market, the ability to grow faster than the core-market rate ends at some point. The electronic-design-automation (EDA) market is a good example of one that has reached maturity and is now limited by growth in the semiconductor market—all design engineers already use some form of EDA software and the number of new engineers is limited based on market-growth prospects. Consequently, key players such as Synopsys, Cadence, and Mentor Graphics have all been exploring alternative paths for growth outside their core EDA-software business. Synopsys ventured into Internet Protocol (IP) licensing, optics, and more recently into software testing. Cadence expanded into IP licensing. Mentor Graphics diversified its business with embedded-software tools, mechanical computer-aided design, and automotive subassembly-design software.

2. Emulate the best

It’s not that business leaders fail to recognize the imperative to transition to Act II. The problem is the challenge of identifying when to do so, what to do, and how to do it. We looked into common practices applied by successful growers and identified three archetypes of successful companies:

- Rocket ships latch onto technological trends and monetization models with broad applicability, such that their subsequent acts simply extend their core business model into additional contexts. Internet giants such as Google and Facebook, with core markets of Internet search and social networking respectively, best exemplify this strategy. For example, Google has extended its digital-advertising leadership from search to third-party content via AdSense and additional cloud-based services (YouTube, Google Maps, Gmail). Similarly, Facebook extended its social-networking leadership from the PC to mobile and has thus maintained about 60 percent year-over-year growth even at $12 billion in annual revenue.

- Adjacency buyers have mastered the art of acquiring and integrating companies to enter adjacent markets. Enterprise players such as Oracle and SAP have heavily leveraged this approach. Oracle, for example, expanded from database software to enterprise applications (the PeopleSoft and Siebel acquisitions) to enterprise hardware (the Sun Microsystems acquisition) to cloud-based solutions (the RightNow Technologies, Taleo, Eloqua, and ResponSys acquisitions). SAP also evolved via acquisitions from its roots as an enterprise-resource-planning and database vendor to an enterprise-applications provider (the Business Objects and Sybase acquisitions) and more recently to cloud-based solutions (the SuccessFactors, Ariba, and Concur Technologies acquisitions).

- Reinventors leverage assets from existing markets to innovate in new markets. Microsoft successfully used this strategy to parlay its leadership position in the PC front end (operating systems and productivity software) to commensurate success in the data center back end. Salesforce.com followed a similar playbook when it opened its infrastructure via the launch of Force.com. This move enabled Salesforce.com to tap into new revenue streams while fostering customer loyalty and generating valuable insight into future product areas.

Would you like to learn more about our High Tech Practice?

3. Timing is critical

It is critical that companies correctly time their move into Act II. Companies that attempt to advance too early face the risk of disrupting current Act I momentum by spreading resources too thin—either financial, managerial, or both. In the early 2000s, one of the early pioneers of enterprise e-commerce services undertook multiple acquisitions to push beyond its core operations into payment processing and e-commerce services for small and medium-size businesses. Unfortunately, these actions diluted focus on the core enterprise business, which resulted in the loss of some key customers and effectively stalled the company’s growth by 2008.

On the other hand, companies that wait too long face the risk of stalling and being unable to recover their previous levels of growth. For example, several traditional packaged-software vendors have become challenged for growth as software as a service has disrupted their markets. Many have not been able to pivot quickly enough to benefit from the rapid growth of cloud computing. At the same time, the increased use of cloud services has reduced the demand for packaged software, stalling growth in their core businesses.

The right time to explore a second act is when a company is unable to meet its three- to five-year growth objectives with its core markets (for example, targeting 15 percent growth in a flat market with stiff competition) or when it finds new high-potential opportunities based on existing assets (such as monetizing internal infrastructure via a platform-as-a-service model). Periodic introspection—such as undertaking customer vintage analysis to identify slowing growth—can help foresee these situations. Such “headlights” should help business leaders evaluate the five fundamental questions in Exhibit 2.

Leaders should ask five fundamental questions.

4. Keep your balance

Companies need to carefully select their second act to avoid markets they are ill prepared to win in—for example, if they’re unable to invest at appropriate scale or have the wrong capabilities to build or sell the right product. It is critical to strike a balance between attractiveness and familiarity during Act II diligence. Focusing too much on attractiveness can leave a company in market without a competitive advantage, while paying too much attention on familiarity can leave a company in a market that’s too close to its core and cannot support its growth ambitions. As an example of high attractiveness but low familiarity, during the dot-com bubble, many traditional software companies acquired Internet companies without a clear strategy or eye toward synergies. As a result, few were able to capitalize on these acquisitions to transform themselves into an Internet giant.

Management teams should individually evaluate their Act II options through the lenses of familiarity and attractiveness. Attractiveness and familiarity can be treated as a set of considerations, which can be quantified or ranked. Ideas can be scored against these considerations to surface top candidates. Some sample considerations are listed on the side as thought starters (see sidebar, “Striking a balance”). The actual choice of considerations for each filter will vary depending on the company’s position, aspirations, and culture.

Finding Act II is difficult, and there is no guarantee of success. Yet it is a requirement for continued survival. The journey begins with recognizing this need and exploring alternatives. Companies may cycle through a few unsuccessful attempts on the way but should not let this deter them. The trick is to remain persistent and to actively exit failed attempts so resources can be focused on new endeavors. In addition, leaders should recognize that multiple business processes—go to market, product development, operations, and support—will likely differ in Act II. Success in the transition will depend on the organizational readiness to adapt to these new requirements.